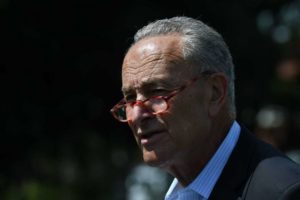

Schumer presses Senate vote on SALT revision, but it fails

WASHINGTON — A legislative maneuver by U.S. Senate Minority Leader Charles E. Schumer to blunt Republican capping of New York’s state and local tax (SALT)

WASHINGTON — A legislative maneuver by U.S. Senate Minority Leader Charles E. Schumer to blunt Republican capping of New York’s state and local tax (SALT)

Destination Maternity filed for Chapter 11 bankruptcy protection Monday, as the apparel company hopes to avoid the growing graveyard of fashion retailers felled by expensive leases

The on again/off again townwide reassessment in Cheektowaga is on again. The Town Board on Tuesday voted 4-2 to reinstate the reassessment, a plan that

WASHINGTON — Senate Minority Leader Charles E. Schumer on Tuesday promised to use a legislative maneuver to force a Senate vote to bolster states like

The historic Village of Hamburg, just south of Buffalo, has a long history predating its formal incorporation in 1874. Surveying in the area

KANSAS CITY, Mo. — Jackson County is now finished with the first phase of reviewing disputes over the big spikes in property tax assessments. All

Keep your eyes open, events are happening fast. Ever since the passage of the Home Valuation Code of Conduct (HVCC) in 2010 and the monumental

(Washington, DC) October 18, 2019 – At a standing room only public meeting, the Appraisal Standards Board (ASB), an independent board of The Appraisal Foundation,

From the Orange County Executive’s Office Orange County Executive Steven M. Neuhaus announced on Friday that Eric Ruscher has been named the County’s Director of

UTICA — Oneida County Executive Anthony Picente Jr. proposed a $439.7 million budget for 2020 earlier this month that featured a zero percent increase to

Sales of single-family homes in the Albany, N.Y., area fell 17.4% in August from year-earlier levels, and real estate officials are blaming a 9% drop

Home buyers still are feeling squeezed by today’s tight housing markets. Prices keep rising moderately. Fewer homes are for sale. And sellers are commanding close